The money transfer platform Wise, formerly TransferWise, offers an easy, cheap, and transparent way to send money abroad.

Below, you will find how you can open an account and send money using Wise.

What Do You Need To Start?

In the next section, I’ll delve into a step-by-step process of opening a Wise account. But before that, you should know that you need to already have a bank account open in order to be able to use Transferwise.

Opening a Wise Account: Step By Step Guide

Step 1

Go to Wise Website

Step #2

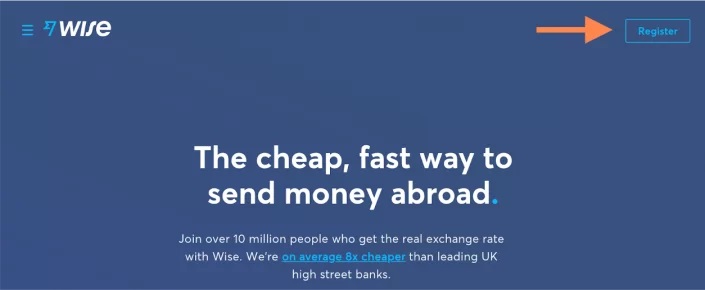

Select “Register”

Step #3

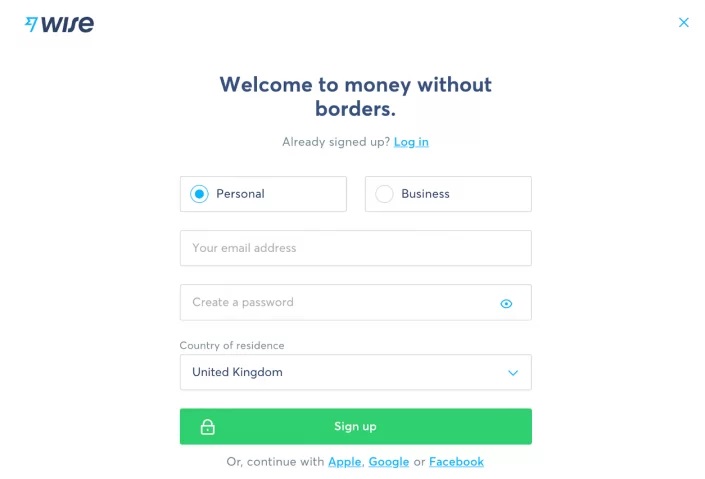

Enter your email address, create a password, and select your country of residence

Step #4

Fill out the required personal information, and voila!

The system will send you an email with a security code or link in order to verify your contact information.

Congratulations, you are part of the Wise family. Now what?

How To Send Money With Wise?

Once you registered with Wise, access the website and log in.

Choose the amount you want to send abroad

At this stage, you’ll know the currency exchange rate and what fee you will pay when the transfer is complete.

Add the beneficiary information and bank account details

Make sure that you've put the correct details.

Verify your identity

The Wise platform will send an SMS with a security code to your mobile phone.

At some cases, Wise may request a copy of your identification document; all good, this is for the safety of your funds.

Pay the transfer amount and the fee

Complete the transfer.

Track the status of your transfer

The beneficiary party will receive a notice that the money is being transferred.

The transfer can take anything from 1 to 2 business days to reach its destination, depending on the date of deposit and the type of transfer you used.

What Are the Fees for Transferring Money With Wise?

Wise provides its users with the commercial exchange rate, not the tourist exchange rate, which is higher. So, the transfer rate can be almost 10 times lower than that of traditional banks.

The fees that are charged vary, depending on the amount you are sending, the currencies you’re using, and the payment method you choose.

The good thing is, you will always transparently see the fees and what they refer to on the simulation page, when you are sending out money.

Wise Transfer Limit

There are limits to how much you can send with Wise. The limits depend on the currencies you send to and from, as well as the method you use to pay. The platform will notify you if you try and send above the limit.

You can check out the limits for each currency in the Wise Currencies pages.

Wise Multi Currency Account

If you are living abroad or moving abroad, the Wise Multi Currency account may be right for you.

The account lets you obtain international bank details and thus receive money worldwide, send money to more than 80 countries, and convert your currency to more than 50 currencies. The bank details you obtain may belong to the United Kingdom, Europe, the United States, Australia, or New Zealand.

You can either register for this account at your initial registration or opt in for it later. Wise will ask you to submit some documents for verification.

Wise Multi Currency Account Fees

There is no monthly fee for the multi currency account. Fees are built into the features.

The currency conversion is performed with the exchange rate of the day. The tariff is typically between 0.35% and 2% depending on the currency. You can withdraw up to €200 every month for free from ATMs all around the world. There is a fixed fee of €0.60 to transfer money from your account to another account with the same currency.

Wise Debit Card

Wise also offers a MasterCard debit card, which is currently only available to the users that live in the European Economic Area (EEA). You can use the card to make withdrawals or payments.

Is It Worth Using Wise To Transfer Money Internationally?

Yes, it is. Here’s why:

Why use Wise?Opening a Wise account is easy and fast, it’s completely online

The platform is easy-to-use

The currency rates and fees are all transparent

Wise offers the cheapest rates and fees

Wise has a wide reach of countries and currencies

The transfer limits are generally high

It’s secure: registered financial institution under FCA in the UK

Comments

Post a Comment